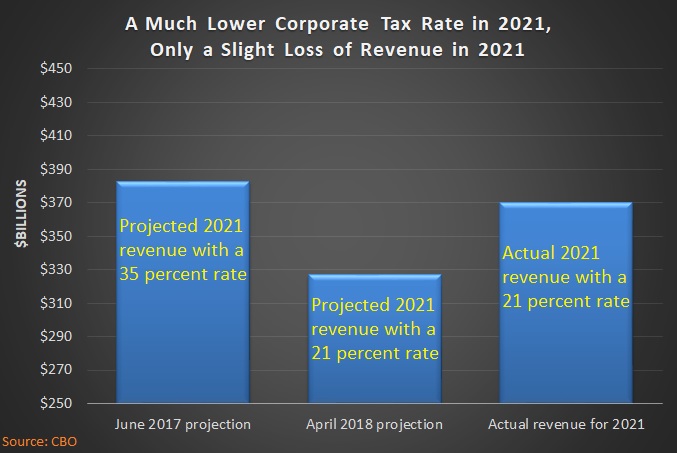

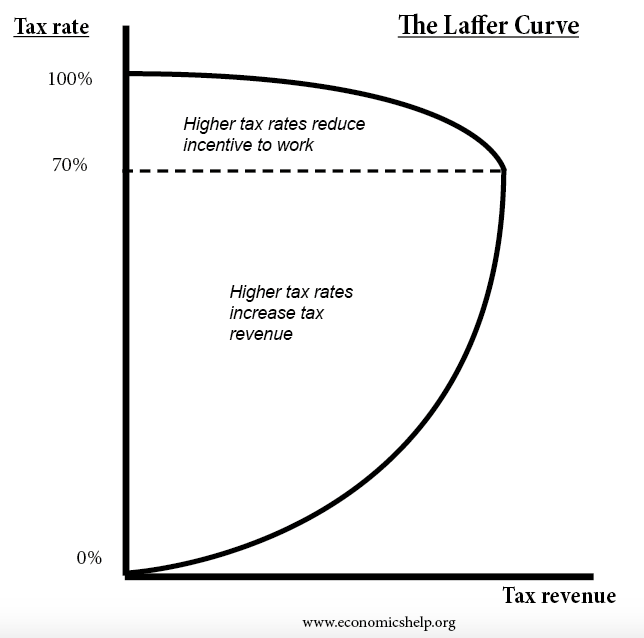

The Laffer Curve Shows that Tax Increases Are a Very Bad Idea -- even if They Generate More Tax Revenue

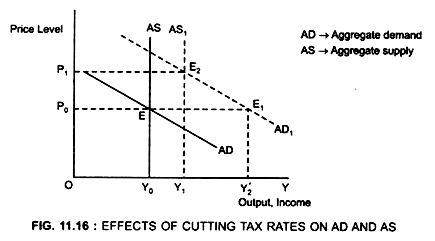

One supply-side measure introduced by the Reagan administration was a cut in income tax rates. Use an aggregate demand/aggregate supply diagram to show what effect was intended. What might happen if such

Explain the changes in aggregate demand and the effects of income tax rate cuts and tax credits for businesses in 3 graphs. Plot three separate graphs for the following scenarios: Changes in

:max_bytes(150000):strip_icc()/LafferCurve2-3509f81755554440855b5e48c182593e.png)

:max_bytes(150000):strip_icc()/graph_laffercurve2-d5238e4a2088452a81e53b92e959c422.png)

:max_bytes(150000):strip_icc()/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)